27 April 2021

To: All firms registered in BCA’s Contractors Registration System (CRS)

This circular informs all contractors registered in CRS that Government Procuring Entities (“GPEs”) have been advised on the following, to:

a) Grant common extension of time (“EOT”) for delay in works due to COVID-19 for period from 7 August 2020 to 31 December 2020, where applicable;

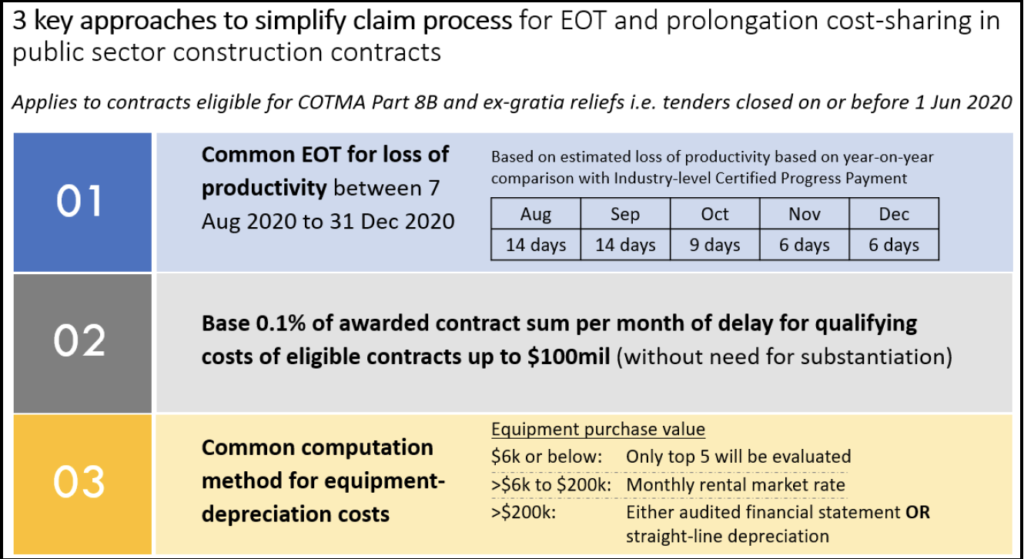

b) Co-share a base 0.1% of awarded contract sum per month of delay for eligible contracts up to $100mil; and

c) Adopt common methods of computation for depreciation of contractor-owned equipment.

Background

2 Following the restart of construction works for most projects in August 2020, many construction projects continue to face challenges in resuming pace of work to pre-COVID levels as they adjust to new requirements such as compliance with the Safe Management Measures (“SMM”) on site, mandatory Rostered Routine Testing (“RRT”) and shortage in manpower due to border controls, etc. As these are unprecedented events, both contractors and GPEs have highlighted the difficulties in substantiating and assessing the EOT and the corresponding prolongation costs for such delay.

3 As informed in BCA’s circular on “Commencement of COVID-19 (Temporary Measures) Act [“COTMA”] 2020 – Part 8A and Part 8B” dated 30 November 2020, the Government will continue to co-share the depreciation of contractor-owned equipment on an ex-gratia basis as part of the prolongation costs notwithstanding that such costs incurred are not part of the qualifying costs under COTMA Part 8B. Both contractors and GPEs have also highlighted the difficulties in substantiating and assessing claims based on depreciation of the construction equipment.

4 As such, BCA, major GPEs, the Singapore Contractors Association Limited (“SCAL”) and other Trade Associations and Chambers (“TACs”) such as the Singapore Institute of Architects (“SIA”) and Singapore Institute of Surveyors and Valuers (“SISV”) have discussed and agreed on 3 key approaches to simplify the claim process for EOT and prolongation costs in public sector construction contracts due to COVID-19 events (see Figure 1 for overview and Para 5 to 8 for details).

Common EOT for delay due to loss of productivity from 7 August 2020 to 31 December 2020

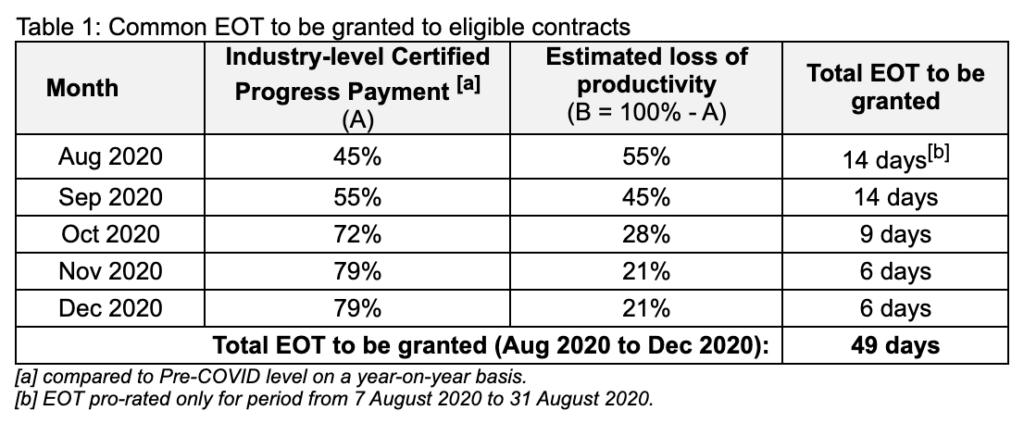

5 We have sought GPEs’ support to grant common EOT for delay due to loss of productivity for the period from 7 August 2020 to 31 December 2020, on an ex-gratia basis1 , for public sector construction contracts2 :

(i) in which the tender was closed on or before 1 June 20203 ;

(ii) that was not terminated by the Employer on or before 7 August 2020 under Clause 31 of PSSCOC (or equivalent clause under the contract); and

(iii) that was not certified to be substantially completed on or before 7 August 2020 under Clause 17 of PSSCOC (or equivalent clause under the contract).

No claim for the common EOT is required from contractors. The common EOT will apply unless GPEs assess there are strong grounds4 which deter the grant of the common EOT. Contractors which wish to seek longer EOT for the same period shall provide the necessary substantiation for GPEs’ assessment. GPEs can grant such longer EOT if they assessed that the requests are appropriate. Refer to Annex A for illustration

1 The period of EOT for the month that the works that were substantially completed before the end of the said month should be pro-rated accordingly.

2 Refers to construction contracts involving works such as building, civil engineering works and addition & alteration (A&A) works. Supply and maintenance term contracts are not eligible for this EOT.

3 Notwithstanding, GPEs have the flexibility to grant common EOT for contracts with tender closed after 1 June 2020 if there are valid justifications to do so (e.g. contract duration was still based on pre-COVID estimate).

4 Example: Design stage in D&B contract where the progress of design works, which are not carried out on worksite, are not affected by the COVID-19 situation. In such cases, GPEs have the flexibility to reduce (or not to grant) common EOT accordingly.

Simplified claim process for prolongation cost claims

6 The following simplified processes for prolongation cost claims will apply for public sector construction contracts:

(a) For eligible contracts with awarded contract sum up to $100mil, GPEs will co-share 0.1% of awarded contract sum for every month of delay arising from COVID-19 events (substantiated with EOT). If the delay period within the calendar month is less than 1 month, GPEs will pro-rate accordingly using the number of days in that calendar month.

We have reminded GPEs to expedite the payment of prolongation cost claims, in particular for the universal 122 days granted under COTMA Part 8A (Tranche 1) and 49 days ex-gratia common EOT (Tranche 2), through the following steps:

Step 1: GPE to calculate co-sharing amount based on 0.1% of awarded contract sum per month of delay and inform the eligible contractor. See Annex B for illustration.

Step 2: The contractor shall include such amount in their next progress payment claim, for GPE’s certification via the payment response.

Note for Para 6(a):

1) To avoid doubt, contractors do not need to submit documentary proof (e.g. invoices and receipts) as substantiation to accompany their claim for the cost-sharing amount in Step 2.

2) If contractors wish to make further claim beyond the 0.1% (e.g. 0.12%), including any ex-gratia payment of contractor-owned equipment, for the same specified period, the contractors shall substantiate the total claim amount[5] (i.e. 0.12%) with documentary proof (e.g. invoices and receipts) for GPEs’ assessment.

3) Contractors which have received such cost-sharing amount from GPEs shall continue to fulfill their obligations to cost-share qualifying costs under COTMA Part 8B with their sub-contractors.

4) Notwithstanding COTMA Part 8B only applies to contracts entered into before 25 March 2020, the base 0.1% co-sharing will also apply to contracts which were entered into on or after 25 March 2020 but with tenders closed on or before 1 June 2020 as informed in Para 4(a) of BCA’s circular “Commencement of COVID-19 (Temporary Measures) Act 2020 – Part 8A and Part 8B” dated 30 November 2020.

5 Total claim amount refers to the total incurred prolongation costs under COTMA Part 8B and ex-gratia contractor-owned equipment for the same specified period. Note 2 of Para 6(b) will also apply. Example: GPE has paid $100,000 (0.1% of awarded contract sum) to contractor for month of May 2020. Contractor substantiates its total claim amount of $120,000 with documentary proof as incurred for month of May 2020 and thereby makes further claim of the additional $20k ($120k- $100k).

(b) For eligible contracts with awarded contract sum above $100mil, main contractors are required to submit breakdown of claim and documentary proof (e.g. invoices and receipts) for claim items with incurred cost[6] above $6,000 as part of the claim.

Note for Para 6(b):

1) For claim items with incurred cost of $6,000 and below, GPEs can have the flexibility to certify the claim without documentary proof if GPEs assess that the claim items are reasonable. However, contractors may be asked to produce documentary proof for audit checks by the GPEs at any time. GPEs may also reserve the right to claw-back any overpayments.

6 Incurred cost refers to the total amount incurred (before 50% cost-sharing) for unique item(s) per service rendered or per calendar month. Example: Suppose, for the month of Sep 2020, the contractor incurred rental cost of 5 identical (i.e. same brand/model) units of 12-metre Boom Lift. The rental cost of each unit is $1,300 per month. In this example, a total incurred cost is $6,500 (i.e. $1,300*5) which is more than $6,000 and would require documentary proof before GPEs’ certification of the cost-sharing payment.

Common methods of computation for depreciation of contractor-owned equipment

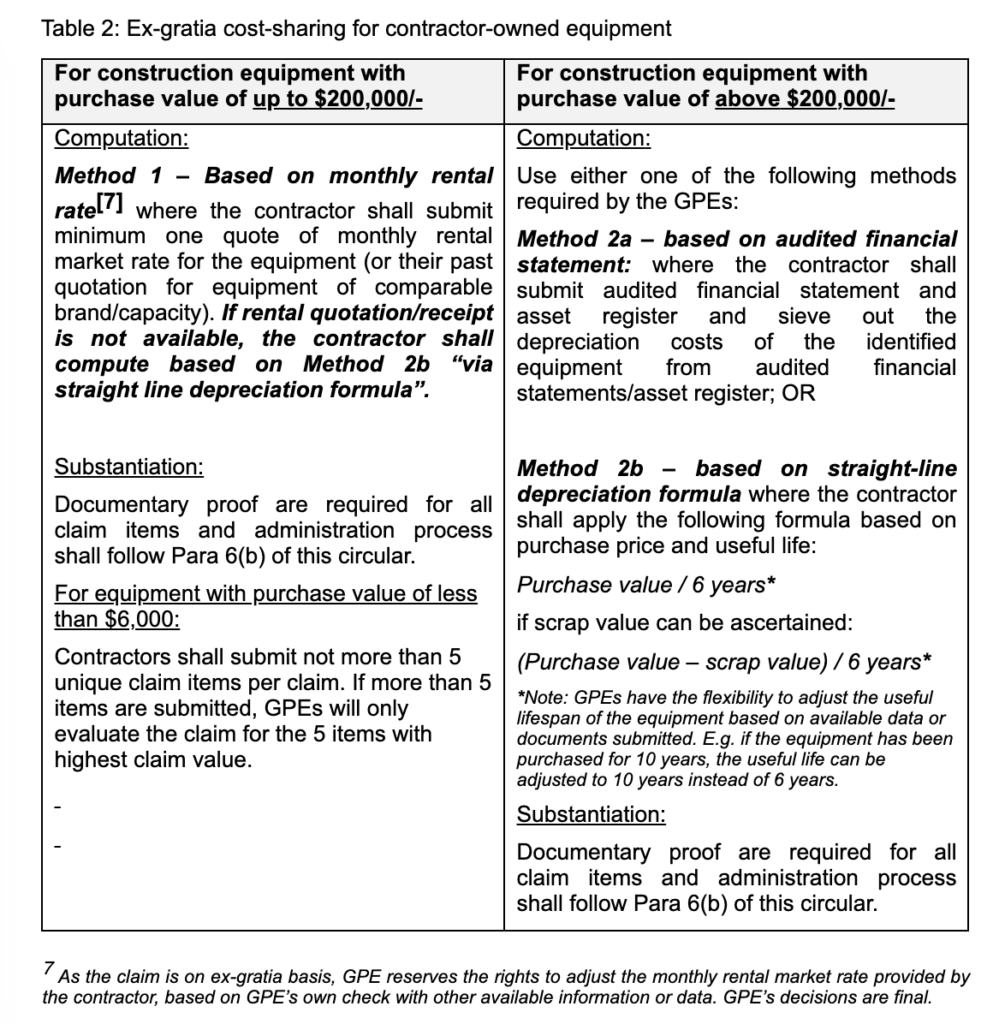

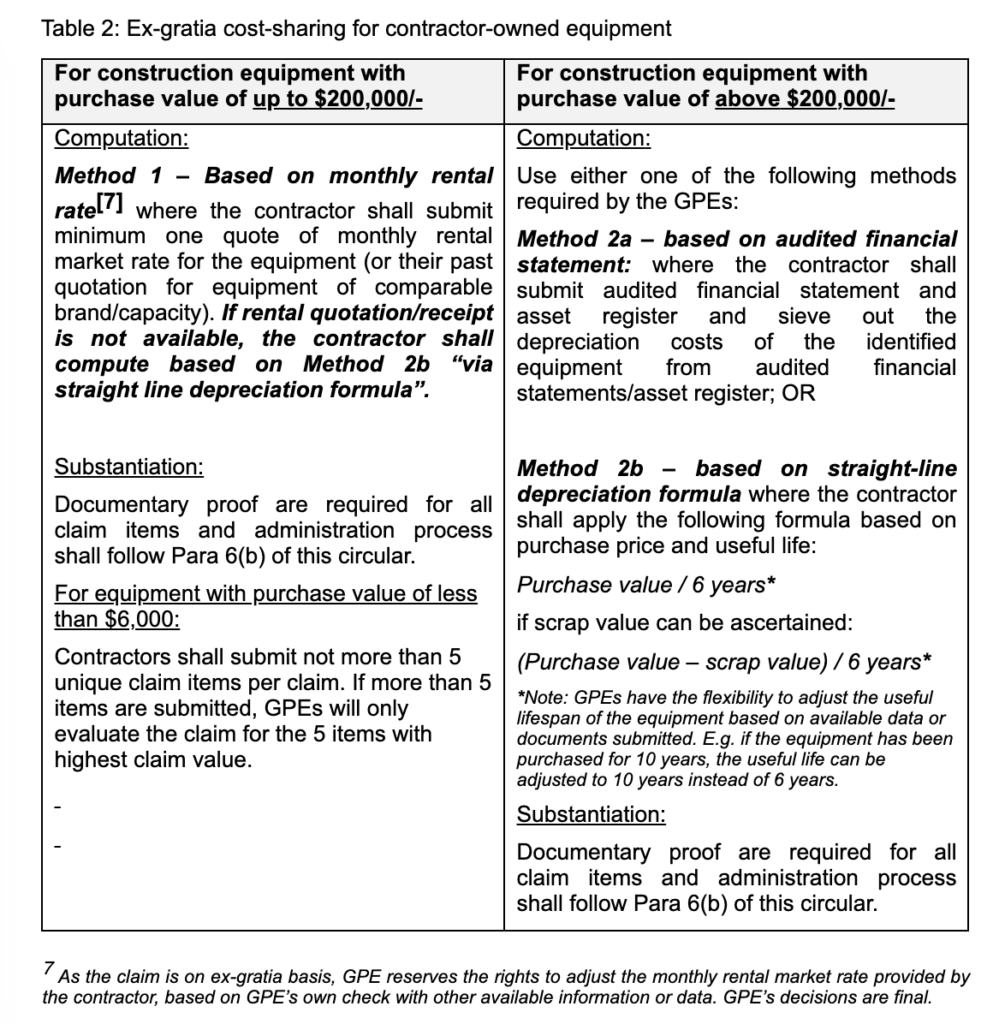

7 For computation of depreciation of contractor-owned equipment, the methods in Table 2 based on the construction equipment’s purchase value and awarded contract sum of the contract will be adopted.

8 To avoid doubt, contractor-owned equipment refers to construction equipment or device designed and intended for use in construction or material handling and is not intended to form part of the permanent works.

- Examples of construction equipment include (but not limited to) excavators, tower cranes, passenger hoists, concrete placing equipment, scaffolds and formwork systems.

- Generic items such as electrical sockets / plug / cable / switches, water pipes, mobile phones, water dispenser, personal computers, desktop monitor, office equipment, wireless router and walkie talkie should not be interpreted as construction equipment.

Combined cap for claims under COTMA Part 8B and ex-gratia cost-sharing of contractor-owned equipment

9 With the above, the total cost-sharing under COTMA Part 8B and ex-gratia co-sharing of contractor-owned equipment would still be subject to the monthly cap of 0.2% of contract sum and overall cap of 1.8% of the contract sum.

Others & Clarifications

10 BCA would like to remind all contractors to remain extra vigilant during this period and take the following steps:

1) Adhere to safe management measures

2) Ensure employees go for Rostered Routine Testing (RRT)

3) Ensure that employees who are feeling unwell see the doctor immediately

11 For clarification on this circular, please direct your queries to https://www.bca.gov.sg/feedbackform/. Please visit BCA’s COVID-19 webpage (www1.bca.gov.sg/COVID-19) and subscribe to BCA’s Telegram channel (https://t.me/BCASingapore) for latest updates.

Thank you.

Ng Man Hon

Director, Procurement Policies Department

Building and Construction Authority